Enterprise-Grade Card Issuance Solution: No-Code, Ready-to-Use

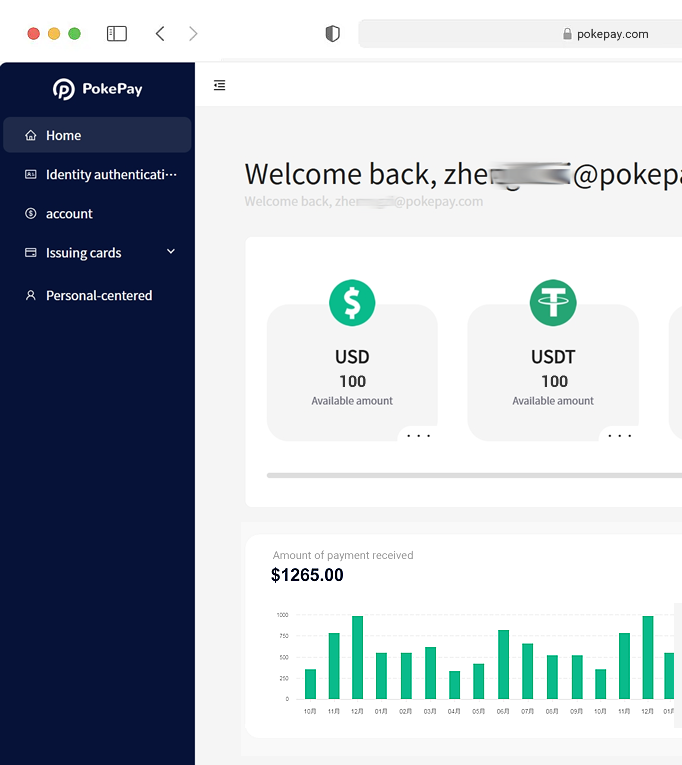

One-click activation of dedicated accounts and cards for partner enterprises and their employees, enabling rapid deployment of global payment capabilities.

Covers both virtual and physical cards, supporting full-scenario usage including online consumption, POS payments, and ATM cash withdrawals.

Provides end-to-end compliance protection, 24/7 security risk control, and real-time settlement, creating a seamless global payment experience.

・ Offers flexible fund management and multi-currency support to help enterprises efficiently expand cross-border business.

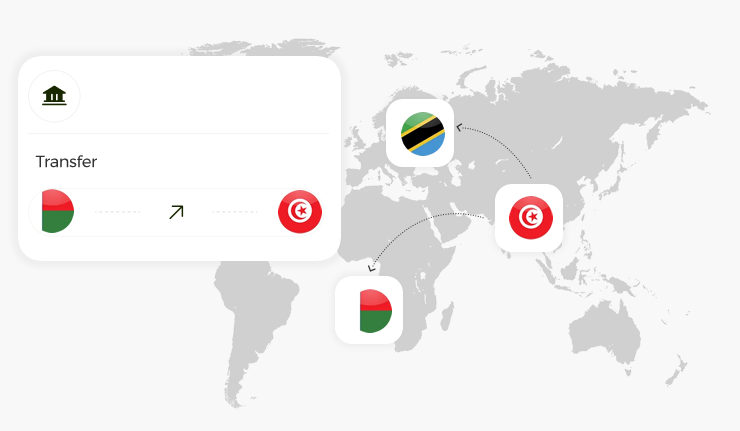

PokePay provides multi-currency Virtual Account (VA) services for corporate clients, supporting major global payment routes (IBAN, SWIFT, SEPA, ACH) to help enterprises quickly establish a compliant, secure, and low-cost cross-border payment and collection system.

・ Overseas collection accounts, supporting multi-currency settlement to reduce foreign exchange costs.

・ Quick integration with e-commerce platforms such as Amazon, Shopify, and eBay.

・ Providing payment and collection services in multiple currencies including USD, EUR, GBP, and HKD.

・ Flexible foreign exchange settlement, compliant and efficient, with reduced intermediate fees.

・ Offering fiat ↔ crypto deposit and withdrawal solutions.

・ Automated payment and collection processing via API, supporting integration with corporate wallets and on-chain assets.

・ Providing secondary sub-accounts for payment companies, OTC platforms, and SaaS financial service providers.

・ Supporting bulk account opening and bulk settlement via API to improve operational efficiency.

PokePay works with Tier-1 companies in the industry for our business operation and business growth.

PokePay OTC provides secure and compliant deposit / withdrawal channels, helping enterprises and individuals easily complete the conversion between fiat currencies and crypto assets.

Deep Liquidity

Covers dozens of mainstream spot currency pairs to ensure smooth execution of large-value transactions.

Diversified Settlement Currencies

Supports multi-currency settlement including USD, EUR, and GBP.

Instant Fund Arrival

Offers settlement as fast as T+0 to meet diverse business needs.

Compliant Risk Control

Relies on KYC / KYB, KYT, and on-chain monitoring to ensure fund security and transparent transactions.

Deep Liquidity Support

Direct connectivity with multiple first-tier liquidity providers ensures smooth execution of large-value transactions, free from constraints of market depth.

Diversified Settlement Options

Enables fast conversion between major fiat currencies (USD, EUR, etc.) and stablecoins (USDT, USDC, etc.), meeting the needs of cross-border enterprises and high-net-worth clients.

Instant Fund Arrival

Offers settlement as fast as T+0, reducing the time funds are in transit and improving capital utilization efficiency.

Compliance Assurance

Backed by a license framework including North American MSB, combined with KYC / KYB and on-chain monitoring, to ensure compliant and secure transactions.

Customized Services

Provides personalized quotes and settlement solutions for enterprises, funds, and professional clients, catering to diverse transaction scales and business scenarios.

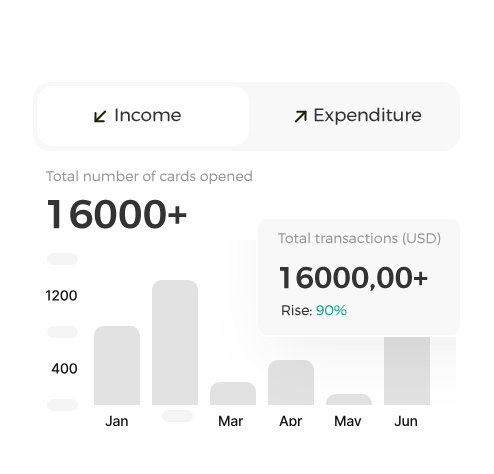

Supports both virtual and physical cards, covering major markets to quickly activate global payment functions.

Provides standardized APIs, SDKs, and an admin backend to help enterprises quickly connect to existing systems.

Leverages multi-country financial licenses and risk control systems to ensure the security and compliance of card issuance and fund flows.

Supports the entire process of card opening, recharging, risk control, reporting, and clearing/settlement, reducing enterprise costs.

Suitable for diverse business scenarios such as employee benefits, customer rewards, cross-border payments, and SaaS tools.

Opens dedicated accounts for enterprises and users, supporting the collection and payment of major fiat currencies such as USD and EUR, as well as stablecoins like USDT and USDC.

Facilitates two-way conversion between fiat currencies and crypto assets, meeting the needs of cross-border payments and fund settlement.

Supports local clearing systems including SWIFT, SEPA, and ACH, as well as crypto networks, covering over 100 countries and regions.

Built-in KYC/KYB, AML/KYT verification, and real-time monitoring to ensure the security and compliance of funds and transactions.

Quickly open multi-currency accounts to improve the efficiency of fund collection and settlement.

Embed account, payment, and withdrawal functions into applications to enhance user experience.

Expand account and clearing capabilities via APIs to reduce costs associated with building in-house compliance systems and capital management infrastructure.

Connect fiat currencies and crypto assets to provide seamless deposit and withdrawal services.

Centralize fund pools, automate reconciliation and settlement, and reduce operational complexity.

Standardized APIs and SDKs enable low-threshold access with no complex development required.

Licensed with North American MSB, European VASP, and other certifications to provide compliance guarantees for business operations.

Supports flexible T+0/T+1 settlement to improve capital turnover rate.

Simultaneously supports major fiat currencies and stablecoins, meeting the needs of global markets.

Comprehensive transaction security is ensured through AI risk control monitoring, on-chain transaction tracking, and real-time notifications.

Modular capabilities can be called on demand to meet the financial needs of different enterprises at various stages.