PokePay offers comprehensive services including Visa credit card issuance, multi-currency virtual bank accounts, crypto/fiat conversion, cross-border transfers, and crypto payment acceptance. Its future plans include launching on-chain wealth management products and RWA (Real-World Asset tokenization) for Hong Kong and U.S. stocks, enabling stock purchases via crypto assets.

It aims to build an integrated financial platform that combines payment + conversion + account + investment, allowing individuals and enterprises to meet cross-border and crypto financial needs without switching between multiple institutions.

User trust

Number of cards issued

Safe operation (days)

The platform adopts a high-performance technical architecture, with core systems developed using strongly typed statically compiled languages. It supports millisecond-level high-concurrency transaction processing, providing users with a smooth experience of real-time fund arrival. Decentralized server deployment enhances access speed and system stability for users worldwide, ensuring the platform operates efficiently on a global scale.

Multi-layered security measures are implemented, including end-to-end encryption, two-factor authentication (2FA), and multi-signature wallet technology, to protect users’ assets and data security. Interfaces such as RESTful APIs provide excellent integration support for merchants and partners, with high scalability and availability to meet the needs of different users and partners.

The platform has a built-in comprehensive KYC (Know Your Customer) and AML (Anti-Money Laundering) system. New users must pass strict identity verification, and transaction activities are monitored 24/7. Relying on an automated risk control engine, PokePay can instantly identify suspicious transactions and quickly respond to the latest regulatory requirements, consistently complying with the regulations of local supervisory authorities to ensure the stable operation of the platform.

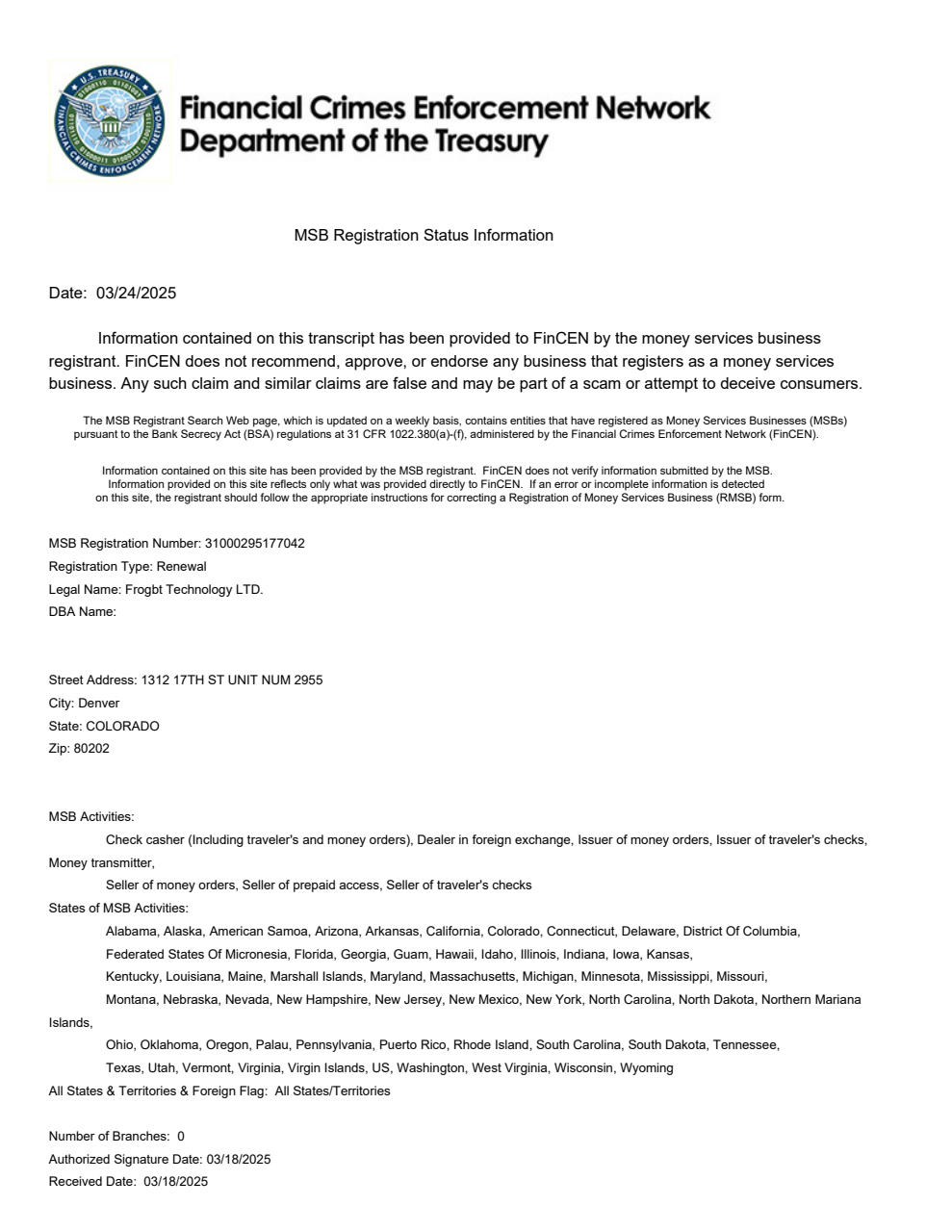

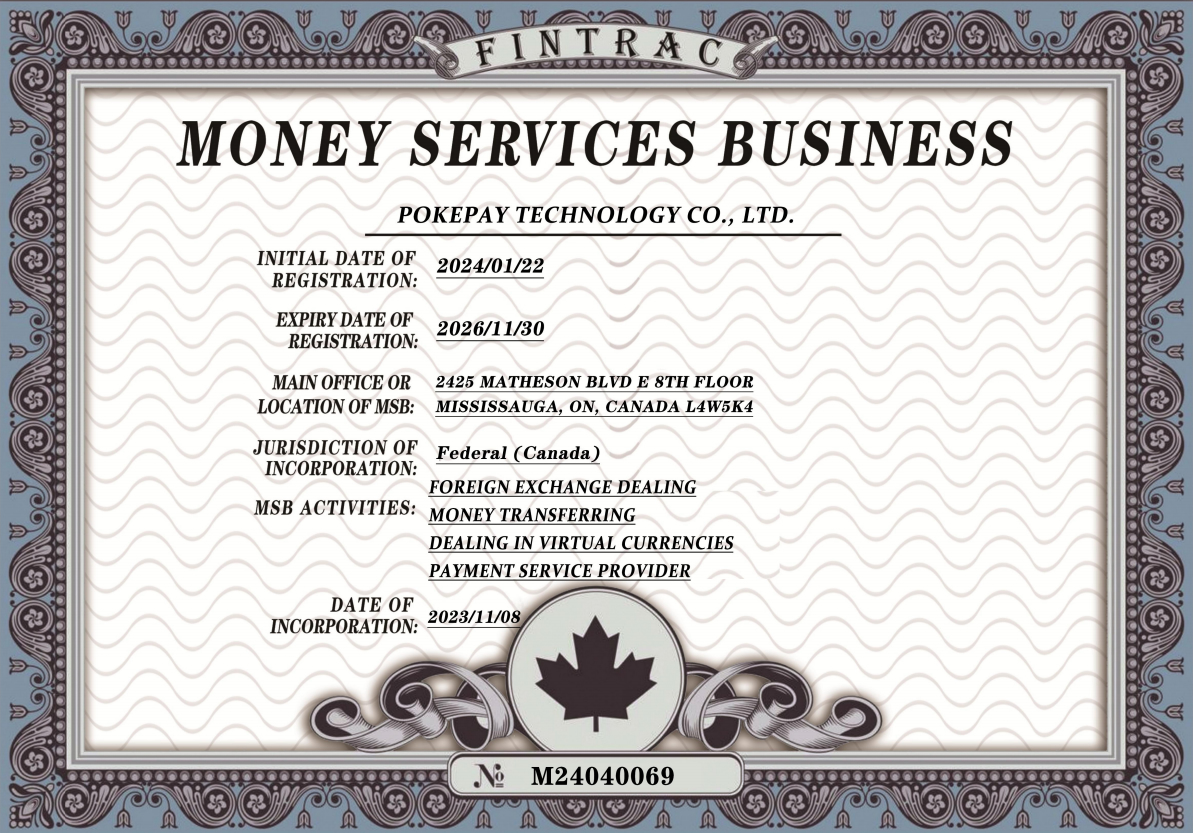

PokePay proactively obtains relevant financial licenses and qualifications in key operating countries and regions. Currently, it holds multiple financial licenses, including U.S./Canada MSB licenses, Hong Kong MLO license, and European VASP licenses, ensuring legal and compliant business operations. Compliant operation is the cornerstone of PokePay’s existence—it helps the platform gain the trust of regulatory authorities and users in industry competition, laying a foundation for large-scale expansion.

PokePay offers a cross-border payment system built on stablecoins and local clearing networks, fully optimizing the cost and efficiency of traditional solutions.

Beyond providing multi-currency accounts and card services, it deeply integrates crypto and on-chain asset functionalities to create a more flexible and open cross-border financial experience.

Compared with traditional crypto card platforms, PokePay delivers a more comprehensive payment account system and global adaptability, along with a dual-account structure supporting both crypto and fiat currencies.

Seeking Partnerships with Upstream and Downstream Stakeholders

PokePay is pursuing collaborations with upstream and downstream partners, including:

Cooperating with exchanges and wallet platforms to onboard crypto users;

Deepening partnerships with institutions like Visa and Mastercard to expand card service offerings;

Integrating payment solutions with e-commerce platforms or merchant service providers to broaden the source of merchant-side clients.

Through close cooperation with various partners, PokePay can integrate resources, expand its business scope, and enhance the platform’s competitiveness and market influence.

PokePay is committed to bridging traditional finance and crypto assets, providing individuals and merchants with secure, convenient, and one-stop global payment solutions. It strives to drive the deep integration of finance and technology, and lead innovation and development in the payment industry.

Chief Executive Officer (CEO) & Co-Founder

Chief Marketing Officer (CMO)

Chief Technology Officer (CTO)

Chief Operating Officer (COO) / Chief Risk Officer (CRO)